Artificial Neural Networks For Predicting Stock Market Trends

The stock market is a complex and dynamic system that is influenced by a variety of factors, including economic indicators, political events, and investor sentiment. For this reason, predicting stock market trends is a challenging task that requires the use of sophisticated methods and techniques.

One such method is the use of artificial neural networks, which are a type of machine learning algorithm that can be trained to recognize patterns in data and make predictions based on those patterns.

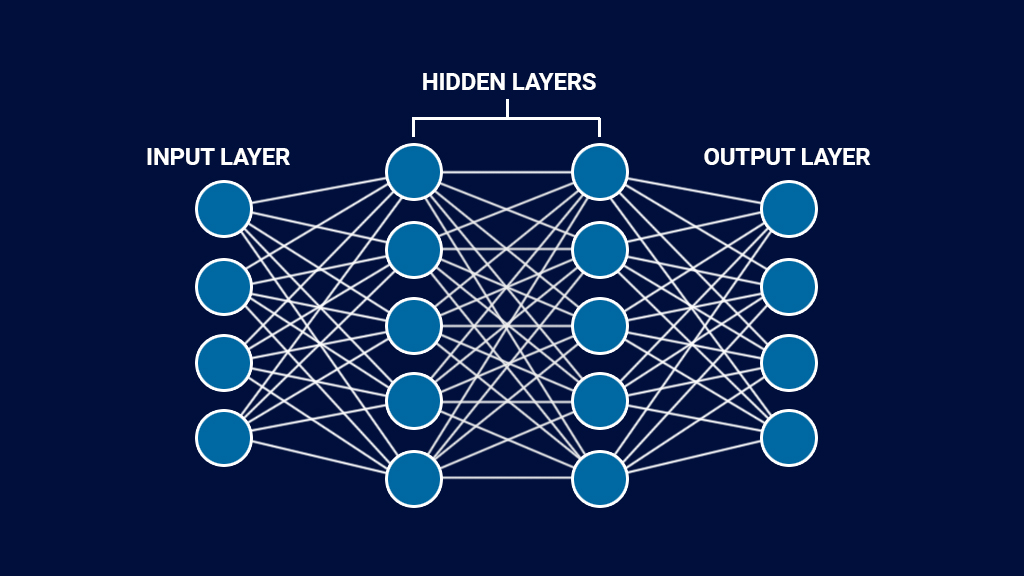

Artificial neural networks (ANNs) are modeled after the structure and function of the human brain. They consist of interconnected nodes or “neurons” that process and transmit information.

ANNs are able to learn and adapt to new information, making them well-suited for complex prediction tasks such as stock market forecasting.

One of the key advantages of ANNs is their ability to identify nonlinear relationships between variables. In the context of stock market prediction, this means that ANNs can capture the complex interactions between different economic indicators and other factors that influence stock prices.

For example, an ANN might be able to identify that changes in interest rates, inflation, and corporate earnings all have an impact on stock prices, even if the relationship between these variables is not immediately apparent.

To train an ANN for stock market prediction, historical stock prices and related economic data are typically used as input. The ANN is then trained to recognize patterns in the data and make predictions about future stock prices.

The accuracy of these predictions can be improved by adjusting the parameters of the ANN, such as the number of neurons in the hidden layer and the learning rate of the algorithm.

Several studies have explored the effectiveness of ANNs for stock market prediction. For example, a study by Zhang et al. (2020) found that a hybrid model combining ANNs and wavelet analysis was able to achieve higher prediction accuracy than traditional methods such as linear regression and ARIMA.

Similarly, a study by Cho et al. (2019) found that an ensemble of ANNs was able to outperform other machine learning algorithms in predicting stock prices.

Despite the promise of ANNs for stock market prediction, there are several challenges and limitations to be aware of. One challenge is the “black box” nature of ANNs, which can make it difficult to understand how the algorithm is making predictions.

This can make it difficult to identify and correct errors in the model, or to explain the predictions to stakeholders.

Another limitation is the potential for overfitting, which occurs when the ANN becomes too specialized to the training data and is unable to generalize to new data. This can be addressed through techniques such as regularization, which penalizes complex models and encourages simpler models that are more likely to generalize well.

Artificial neural networks represent a formidable resource for forecasting stock market trends. By taking into account the intricate interplay between various economic indicators and other factors that bear upon stock prices, ANNs can learn from past data and generate precise predictions.

Despite their undeniable potential, though, ANNs also come with certain challenges and limitations. One of the main drawbacks is their opaque nature, which makes it difficult to explain how they arrive at their predictions.

Additionally, overfitting can be a concern. As a result, more research is necessary to fully harness the power of ANNs for stock market prediction and to develop models that are both transparent and interpretable.